Share This Article

Is this a replay of the 2008 Financial Crisis?

As you probably know, FDIC and related federal agencies took over three banks over the weekend. Most notable was the failure of Silicon Valley Bank. Because of their investments in US Treasury Bills and the write-downs, they suffered when they had to sell them to generate cash. This sent the stock market, bond markets, crypto, gold, and commodities markets all into crisis mode. For those who can remember 2008, the banking crisis started the 2008 financial crisis. Not fun times!

So will we have another housing crisis? I don’t think so. This appears to be a limited failure for medium and small-sized banks that were not regulated properly. I will let the politicians and media decide who exactly is to blame. My conclusion is that the housing market is probably going to benefit from this more than other markets. In the famous words of Rahm Emanuel is 2008, ” You never let a serious crisis go to waste. And what I mean by that it’s an opportunity to do things you think you could not do before.”

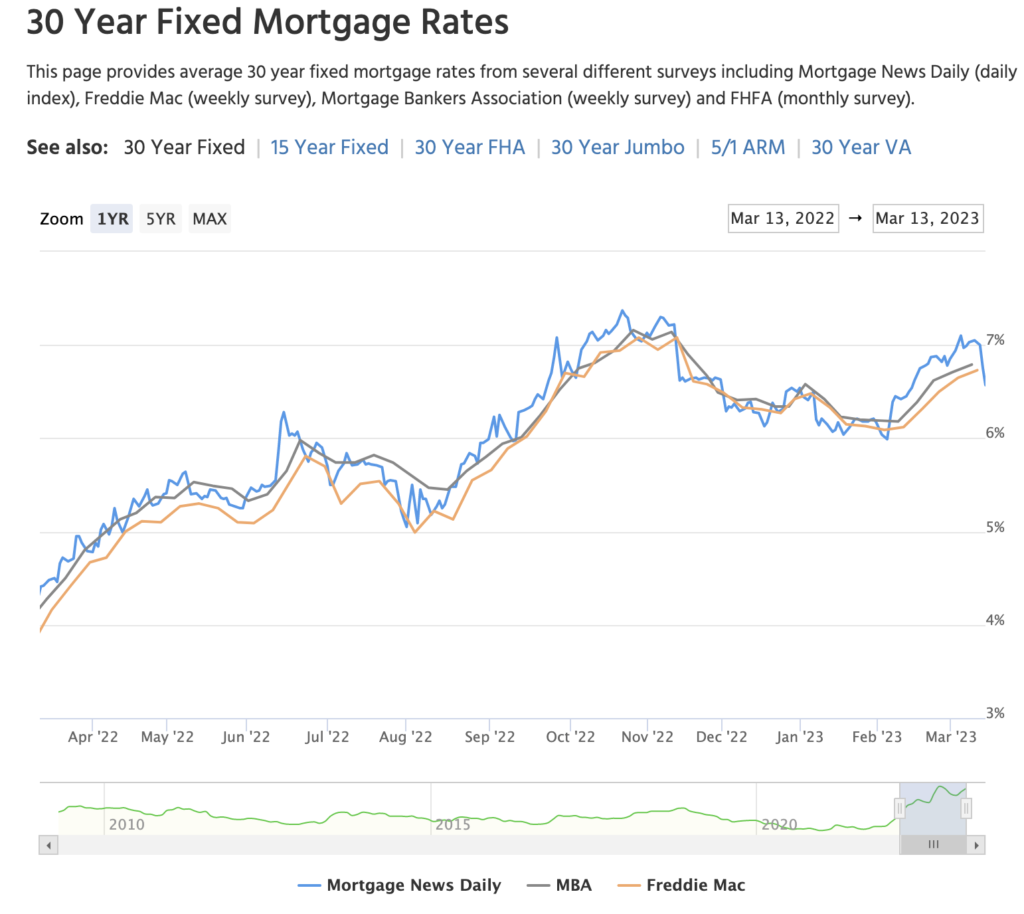

If you are trying to bull or sell real estate right now, the market was not cooperating before Friday, March 10th. Inflation was surging again, and it was definitely looking like the Federal Reserve was going to raise short-term rates again. Mortgage rates spiked, and business slowed down. Then on Friday, mortgage rates fell! Investors ran to US Treasuries, snapping them up and raising the cost to buy them, which meant yields dropped, and all of a sudden, mortgages and houses became more affordable. So while the rest of the world markets are in crisis, the real estate market is now cheaper. This is the time to act if you need to buy or sell.

Here is a chart of what happened with 30-year mortgage rates. Look at the drop on Friday and the continued drop today.

Inventory of available homes to buy remains low. Still, most of the world is now distracted, or people inadvertently come to the conclusion the housing market will fall into a housing crisis. So they are staying away, which means less competition for you as a seller or as a buyer. Buyers have more purchasing power today because of the crisis, but that can change as quickly as tomorrow when another crisis pops up. Is it just me, or is everything a crisis nowadays?

Interested in learning what’s for sale in Arizona? Click here to search real estate listings.

Contact me with any questions, and remember not to miss out on this opportunity. Who knows how long it will last?